This includes companies dealing with commodities, such as oil and gas firms, or those with inventory that doesn’t deteriorate, like metal or chemical producers. LIFO can offer tax benefits when prices are rising by showing reduced profits on paper. For instance, during a sharp rise in oil deducting non prices, an energy company using FIFO might report artificially high profits as sales are matched with older, cheaper inventory. This discrepancy can result in misleading financial statements that don’t accurately reflect the company’s true financial position or operational challenges.

Chemical Industries: Maintaining Product Integrity

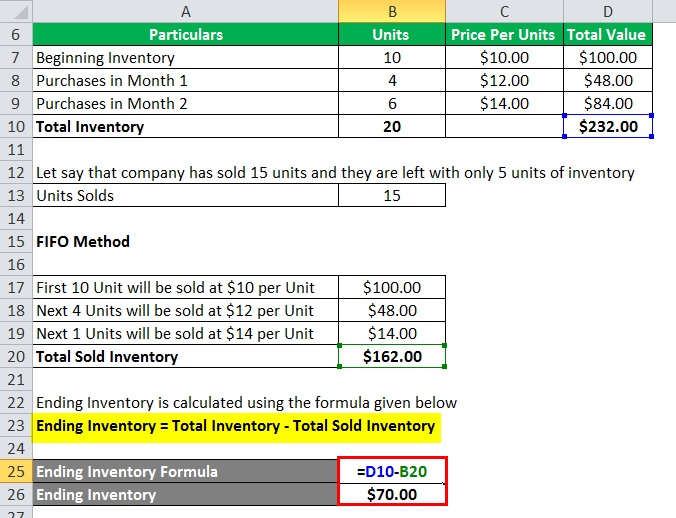

We’ll also compare the FIFO and LIFO methods to help you choose the right fit for your small business. Warehouse management refers to handling inventory and similar tasks within a warehouse environment. Suppose the number of units from the most recent purchase been lower, say 20 units. We will then have to value 20 units of ending inventory on $4 per unit (most recent purchase cost) and the remaining 3 units on the cost of the second most recent purchase (i.e., $5 per unit). Therefore, the value of ending inventory is $92 (23 units x $4), which is the same amount we calculated using the perpetual method.

May Not Reflect Inventory Flow

It also aids in better inventory management by helping businesses make more informed decisions about restocking, pricing, and product lifecycle management. They will handle all of the tedious calculations for you in the background automatically in real-time. This will ensure that your balance sheet will always be up to date with the current cost of your inventory, and your profit and loss (P&L) statement will reflect the most recent COGS and profit numbers. In other words, the costs to acquire merchandise or materials are charged against revenues in the order in which they are incurred. According to a report in The Wall Street Journal, 55% of S&P 500 companies use FIFO as their primary inventory method. FIFO, or First In, Fast Out, is a common inventory valuation method that assumes the products purchased first are the first ones sold.

Methods of calculating inventory cost

For instance, those selling commodities with fluctuating prices may benefit from the average cost method rather than FIFO. The FIFO method avoids obsolescence by selling the oldest inventory items first and maintaining the newest items in inventory. The actual inventory valuation method used doesn’t have to follow the actual flow of inventory through a company but it must be able to support why it selected the inventory valuation method. Theoretically, the cost of inventory sold could be determined in two ways.

Consider Real Inventory Flow

So, Lee decides to use the LIFO method, which means he will use the price it cost him to buy lamps in December. To calculate the Cost of Goods Sold (COGS) using the LIFO method, determine the cost of your most recent inventory. LIFO, or Last In, First Out, is an inventory value method that assumes that the goods bought most recently are the first to be sold. When calculating inventory and Cost of Goods Sold using LIFO, you use the price of the newest goods in your calculations. Choosing between FIFO and LIFO ultimately comes down to financial strategy. When considering which to use, businesses must weigh strategic considerations like financial reporting, tax implications, and compliance with standards.

- It is one of the most common methods to value inventory at the end of any accounting period; thus, it impacts the cost of goods sold during the particular period.

- This will facilitate inventory movement, picking, and packing based on product arrival dates.

- Effective training aligns staff practices, reduces mistakes, and improves overall inventory accuracy.

- Extensiv also enables real-time visibility into inventory levels and product aging, facilitating FIFO adoption.

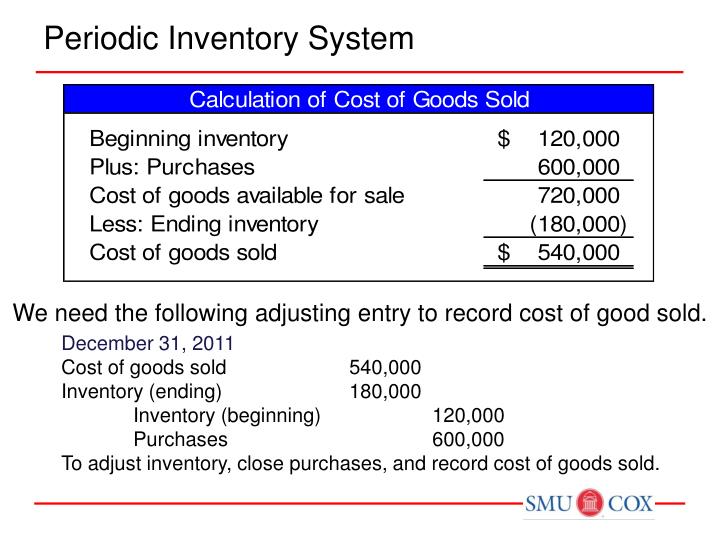

FAR CPA Practice Questions: Journal Entries for Treasury Stock Transactions

Companies must make an assumption about their flow of inventory goods to assign a cost to the inventory remaining at the end of the year. Businesses using the LIFO method will record the most recent inventory costs first, which impacts taxes if the cost of goods in the current economic conditions are higher and sales are down. This means that LIFO could enable businesses to pay less income tax than they likely should be paying, which the FIFO method does a better job of calculating. It makes sense in some industries because of the nature and movement speed of their inventory (such as the auto industry), so businesses in the U.S. can use the LIFO method if they fill out Form 970. It’s also the most accurate method of aligning the expected cost flow with the actual flow of goods. It reduces the impact of inflation, assuming that the cost of purchasing newer inventory will be higher than the purchasing cost of older inventory.

When you insert a coin and turn the knob, those gumballs at the bottom, which went in first, will be the ones that come out first. The gumballs remaining in the machine at the end of the period—your inventory—are the gumballs that were added last. The goods that you first purchased will be the first ones to go to COGS upon sale. Using the FIFO method makes it more difficult to manipulate financial statements, which is why it’s required under the International Financial Reporting Standards.

Under the FIFO, the goods that were purchased most recently should be part of ending inventory. Yes, FIFO is still a common inventory accounting method for many businesses. It’s required for certain jurisdictions, while others have the option to use FIFO or LIFO.

First in, first out (FIFO) is an inventory method that assumes the first goods purchased are the first goods sold. This means that older inventory will get shipped out before newer inventory and the prices or values of each piece of inventory represents the most accurate estimation. FIFO serves as both an accurate and easy way of calculating ending inventory value as well as a proper way to manage your inventory to save money and benefit your customers. The company’s accounts will better reflect the value of current inventory because the unsold products are also the newest ones. Typical economic situations involve inflationary markets and rising prices.

If these products are perishable, become irrelevant, or otherwise change in value, FIFO may not be an accurate reflection of the ending inventory value that the company actually holds in stock. To calculate the value of inventory using the FIFO method, calculate the price a business paid for the oldest inventory batch and multiply it by the volume of inventory sold for a given period. The FIFO method can result in higher income taxes for a company because there’s a wider gap between costs and revenue. The alternate method of LIFO allows companies to list their most recent costs first in jurisdictions that allow it.

Connect with our sales team to learn more about our commitment to quality, service, and tech-forward fulfillment. Many industries with perishable goods use FIFO, including food and beverage, pharmaceuticals, and retail. Other industries may also utilize FIFO to manage inventory and ensure product quality. Consider using FIFO based on its benefits and whether or not your business handles perishable goods, products with expiration dates, or rapid product turnover. Since inventory is an asset, it’s important to keep insight into your actual inventory values. FIFO is particularly effective in industries with rapidly changing product lifecycles or seasonal demand patterns because it helps businesses more effectively adapt to fluctuating market conditions.